This section gives you quick and easy access to the answers to the questions we're asked most frequently.

What is ECACH?

The Eastern Caribbean Automated Clearing House (ECACH) is an electronic network through ECCB for clearing and settlement of cheques and other electronic transactions within the eight territories of the Eastern Caribbean Currency Union (ECCU). Only commercial banks within the ECCU are participating.

What is EFT?

Electronic Funds Transfer (EFT) refers to transactions that take place over the ECACH electronic payment network, either among customer accounts at the same bank or among customer accounts between participating banks locally & regionally.

Why is EFT being launched?

The ECACH is launching EFT in an effort to provide the customers of banks within the ECCU a faster, cost-effective and secure payment solution.

What are the benefits of EFT?

The EFT process is secure, fast, convenient and cost-effective. It provides customers with the ability to transfer and settle funds between participating banks within the same day, subject to the agreed exchange timelines between the participating banks

What type of transactions can be processed through EFT?

The transactions can be funds transferred to accounts such as payroll, settlement of invoices, tax refunds, pension, dividends, etc.

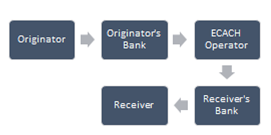

How does EFT work?

A company (Originator) will send a list of transactions/payments to be made on the accounts of its employees, clients, or suppliers, to its Financial Institution (Originator’s Bank) using the ACH software. The Originator’s Bank will send these transactions in a specific format to ECCB (ECACH Operator) for transmission to the Receiver’s/Beneficiary’s Bank (the employees, clients, or suppliers) where their accounts are held. The Receivers’ banks will in turn process these transactions.

What action is required and by whom?

All businesses and individuals that are doing payroll transactions via an FI and/or individuals that transfer money or pay bills within the Eastern Caribbean are impacted by the introduction of EFT. Through the new features of ACH business customers will now have the opportunity to bring all transactions to one Financial Institution within the Eastern Caribbean. With EFT there is no longer a need to split payroll and the way that people receive their money is changing. This can now be processed by one single FI.

What information will be required from employees, clients or suppliers?

- Name

- Account number(s)

- Account type(s)

- Bank routing/transit number(s)

- Reference #

How long does the application process take?

Up to five (5) business days for enrolment, subject to the completion of forms and approval.

Will the manual salary/payroll sheets still be accepted?

Yes. However, this manual process will be phased-out (A deadline date will be established by ECCB/ECACH). ECACH EFT will be the standard for processing salaries/payroll, and all customers wishing to benefit from this service will be required to enroll.

What is the Eastern Caribbean Securities Exchange (ECSE)?

The Eastern Caribbean Securities Exchange (ECSE) is a regional securities market, established by the Eastern Caribbean Central Bank and licensed under the Securities Act (2001). The ECSE is designed to facilitate the buying and selling of Securities for the eight (8) ECCB member territories of Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, St Kitts and Nevis, St Lucia, and St Vincent and the Grenadines. The ECSE is headquartered in St Kitts.

Where and how do I purchase or sell a Security on the ECSE?

Investors can only purchase Securities through a Broker-Dealer firm registered with the ECSE. BOSL Investment Banking Services is a registered Broker-Dealer, and investors seeking to buy or sell securities can make an appointment with our Registered Principal. Investors purchasing or selling Securities for the first time with BOSL Investment Banking Services must open a new brokerage account.

What is a Security?

A Security is a negotiable instrument representing financial value. Securities are broadly categorized into debt securities, that include Bonds, Debentures and Treasury Bills; and Equity Securities. Examples of Securities that are traded in the regional capital and financial markets include Stocks, Corporate and Government Bonds and Treasury Bills.

What happens when I purchase Securities listed on the ECSE?

Securities of all companies listed on the ECSE are held in dematerialized form. This means that as an investor you will not receive a physical certificate to confirm your proof of ownership for securities purchased. Once you purchase a Security, it will be held in dematerialized (electronic form) at the Eastern Caribbean Central Securities Registry Limited (ECCSR), which is a fully-owned subsidiary of the ECSE. As an investor you will receive a statement of all the Securities you own on a semi-annual basis. Investors can also request BOSL Investment Banking Services to hold the Securities on their behalf.

What is a Securities Market?

A Securities Market is where investors who are willing to buy and sell their Securities. Investors include individuals, institutions, pension funds, trust funds and other entities. The buying investors are willing to invest by purchasing securities from the sellers which include corporations, governments and other investors.

Can I open a joint account?

Yes, investors can open joint accounts.

There are two (2) types of accounts: With a Joint Tenant account, all the signatories on the account are required to collectively give permission for any action on the account. Upon the death of any one (1) joint owner, the surviving joint tenants get the whole account automatically, regardless of any will made.

With Tenants in Common account, upon death of a co-tenant, his or her shares pass to his/her beneficiaries through the Will or Rules pertaining to intestacy.

Can I use my Securities as collateral for a loan?

Investors can use their Securities as collateral for loans. A Charging Form must be completed by all the parties involved.

Can I transfer my Securities as gifts?

Shareholders or joint shareholders can donate all or a portion of their Securities to a family member or to a registered Charity. To donate securities, complete the Donation Transfer Form and submit the completed form notarized or signed and stamped by a licensed broker to the ECCSR together with evidence of the family relationship or the registered Charity. A fee of EC$20.00 is applicable for this request.

How can I obtain a statement of my Securities?

You can request a copy of your Securities statement by simply completing an Application for ECCSR Statement and submitting it to your Registered Representative at the Broker-Dealer Firm. An application fee of EC$20.00 is required.

What happens if my payment is not made by the stipulated date?

You have ten (10) clear days from the date of repayment to make your loan payment. If the payment is not received within the ten days, you will be charged a late payment fee of EC$62.

What areas of study does the Bank finance?

Areas on the Priority List. Areas not on the Priority List can be financed at the Bank’s discretion.

What is the maximum funding limit for my area of study?

The funding limits for the various areas of study are as follows:

- Certificates and Diplomas - EC$60,000

- Associate Degrees - EC$80,000

Studies within the region:

- Bachelor’s Degree - EC$120,000

Regional or International (Bachelor’s Degree):

- Law/Medicine/Architecture - EC$150,000

- Masters Degree - EC$150,000

International:

- Bachelor’s Degree (Bank’s discretion) - EC$150,000

Can I increase or reduce my loan amount?

Yes! Provided that you remain within the maximum limit and you must note that the security and insurance may also need to be adjusted. Visit the branch to discuss restructuring your existing facility.

Can I receive funding to pursue summer courses?

Yes! However you should provide documentation from the school stating that pursuing summer courses would accelerate the completion of your programme and not adversely affect costs.

How is the interest on a student loan calculated?

The interest during the study/grace period is compounded; however you only pay interest on the disbursed funds. When you commence repayment of the loan, the interest which is paid is calculated on the reducing balance.

Is all the interest paid within the grace period?

No! Interest will be paid during the entire life of the loan.

What is the role of a guarantor?

The guarantor’s role is to secure the loan. Should the student become delinquent in the repayment of the loan the repayment becomes the guarantor’s responsibility.

What is the purpose of having life insurance coverage?

Life insurance is required for all student loans. Should a student meet his/her untimely death, the insurer’s coverage is applied to pay off the student’s loan. Otherwise, your guarantor/surety is responsible for repaying the loan or the security is used to liquidate the debt.

What happens if my life insurance policy lapses?

Students are required to submit statements from their Life Insurance Company indicating that their policies are up to date prior to the disbursement of funds. If the policy lapses and is not reinstated, the insured is not covered and in the event of an untimely death, the surety/guarantor will be responsible for the repayment.

Is there a minimum number of redeemable points?

No there is no minimum number. This is one of the key benefits of [My Rewards].

Can I redeem my points for cash?

This option is not available with [My Rewards].

Can I use my points to make payments to my card?

Currently, this option is not available with [My Rewards].

Do I get points for my present balance?

Points are earned solely by making purchases using your BOSL Visa Credit Card.

What are the benefits of My Rewards?

[My Rewards] offers many benefits to loyal BOSL Visa Cardholders:

- Millions of Travel Related Redemption Options

- Fare Rules Benefits (Such as no Cancellation/Rebooking Fees)

- Split Payments (Points + Credit/Debit Card, Only Points, Only Credit/Debit Card)

- No Fees

- No minimum points required

- Superior customer service & single point of contact for travel itinerary inquiries.

If points are earned from a fraudulent transaction and I am refunded thereafter; will the points be deducted after the refund is received?

Yes. Points are earned solely through legitimate purchase activity.

Can be points be reversed?

Yes. Points can be reversed, including circumstances cited in point #15.

Are points transferable to other cardholders?

Points are non-transferable, and are to be used solely by cardholder.

Will my existing PIN continue to work?

Yes, your existing PIN will continue to work

How long does it take for my new PIN once created online to become effective?

The PIN change is immediate. You can start to use our card as soon as you have confirmed the new pin on the Card Inquiry Portal https://www.4csonline.com/CardInquiry/logon.aspx?cthm=BOSL

How many times can I change my PIN?

There are no restrictions on the number of times you can change your PIN.

Do I need to know my current PIN to be able to change to a new PIN?

No. Once you have logged onto the Card Inquiry Portal and your credentials are verified, you can create a new PIN without having to remember your old PIN

Do I need to sign-up for the Online Card Inquiry before I can use this Service?

Yes. This will allow the system to confirm your identity and grant you access to the other features of the Card Inquiry platform.

Is there a minimum amount that I can deposit on such an account?

The minimum investment is EC$500,000 or US$200,000.

Do I receive statements after opening the account?

Yes. You receive annual statements from Bank of Saint Lucia which show all the details of the PFIA.

What is the Premium Fixed Income Account (PFIA)?

A Premium Fixed Income Account is a fixed income,term deposit account available at Bank of Saint Lucia Limited.

What is the investment objective of the PFIA?

To provide investors with returns above the ordinary savings rate through the generation of a predictable flow of income.

How long can I maintain a deposit in a PFIA?

Your deposit in a PFIA can be for a minimum of thirty (30) days or as long as over one (1) year.

Are there any risks associated with this deposit?

All investments carry some degree of risk. Notwithstanding,PFIA investments carry the full weight and backing of Bank of Saint Lucia Limited.

Can I withdraw from the account before maturity?

Withdrawals prior to maturity are not allowed. To facilitate drawdowns the account would have to be closed and subject to penalty.

Can I use this account as collateral for loans?

Yes. The PFIA can be used as collateral for your loans.

Who can invest in a PFIA?

Both individuals and institutions can utilize the PFIA.

Will this deposit be accepted as a prescribed security by the Registrar of Insurance?

Yes. Insurance companies utilizing the PFIA can pledge the account with the Registrar for their statutory requirements.

Is there a time limit for my Edu Start Investment?

The Edu Start account must be held for a minimum of three years and a maximum of fifteen years.

Can I close my Edu Start account before maturity?

Yes, however, there is a penalty for early closure.

On maturity, will I be eligible for a Bank of Saint Lucia Student Loan?

Yes, Edu Start account holders also receive special discounts on fees (normal lending terms and conditions apply)

How do I apply for a Bank of Saint Lucia Visa Credit Card?

You can apply online via our Digital Branch or visit any branch to start the application process.

What are the requirements for a Bank of Saint Lucia Visa Credit Card?

To apply for a Bank of Saint Lucia Visa Credit Card, you will need the following:

- Recent Job Letter

- Recent Salary Slip

- One (1) valid national ID

- Completed Application form

How long does it take to get approved for a credit card?

Approval times can vary, but it's usually within a few days (existing customers) to a few weeks (new customers).

What is a credit limit, and how is it determined?

A credit limit is the maximum amount you can charge on your card. It's determined based on your creditworthiness and income.

What is the minimum payment on a credit card, and how is it calculated?

The minimum payment is a small percentage of your balance, usually around 3%. It's important to pay more than the minimum to avoid high-interest charges.

Are Credit cards only for emergencies?

Credit cards can be a valuable financial tool for everyday expenses and can also offer rewards.

Can I make just the minimum payment each month?

Yes, you can make the minimum each month by the due date as late fees would be avoided, however it is advisable to pay in excess of the minimum payment to reduce interest charges or full statement balance for no interest altogether.

Are there any rewards or benefits associated with the LEAF Visa Credit Card?

Yes, the LEAF Visa Credit Card offers various benefits, including My Rewards, fraud protection and educational resources for responsible credit use. Additionally, cardholders may enjoy promotions and offers from BOSL and Visa. The card limit can also be increased based on good repayment habits.

Can I use the LEAF Visa Credit Card internationally?

Yes, the LEAF Visa Credit Card can be used worldwide wherever Visa is accepted, providing convenience and flexibility for your transactions both in-person and online.

How do I make payments to my LEAF Visa Credit Card?

You can make payments through various channels, including online banking, in-branch payments, and automatic debit from your BOSL account.

What should I do if I encounter issues with my LEAF Visa Credit Card?

If you experience any issues with your card, please contact BOSL Digital at 456-6999, use the numbers on the back of the card for support 24/7 or email bosldigital@bankofsaintlucia.com, cardservices@bankofsaintlucia.com or cardsupport@bankofsaintlucia.com for assistance. Our team is ready to help resolve any problems you may encounter.

How can I monitor the transactions on my LEAF Visa Credit Card?

You can register and monitor your card via the Credit Card Portal. We automatically send you transaction alerts for your card which you will receive either email every time your card is used.

Can I make just the minimum payment each month?

Yes, you can make the minimum each month by the due date as late fees would be avoided, however you are free to apply credits to your account and have the funds available immediately by using our Mobile Banking platform at no cost.

What is Home Flex?

A Home Flex is a revolving credit facility that allows you to access cash based on the STC value on all existing Hypothecs (original mortgage amount) and your mortgage balance. It is similar to having a credit card where you can borrow, repay, and borrow again as needed.

What is the Interest rate?

The interest rate is 5.75%.

How does it work?

You'll get a Home Flex chequing account with an approved limit. Funds can be transferred 24/7 from the Home Flex account to your regular operating account via online banking.

What are the key features of Home Flex?

- Flexibility to borrow against your home equity, repay, and repeat.

- Access funds anytime through online banking transfers.

- Ability to make ongoing withdrawals up to the account limit until the 3-year period ends (then renewal or conversion to loan options).

- Minimum monthly payments of at least 3% of the balance via standing order are required.

Can I make additional payments towards my Home Flex?

Yes, extra lump-sum principal payments during the Home Flex account life is advised. This can help reduce your balance and give you continued access to funds if needed.

What happens when Home Flex matures or is converted to a loan?

If converted to a loan, the maturity date cannot extend past your existing mortgage maturity date or age 65 (unless you have enduring earnings beyond age 65). Converted loans will have principal and interest repayments at the same rate as Home Flex.

How do I renew or convert my Home Flex account after the 3-year period?

Renewal or conversion options are available pending approval after assessment. Contact your Loans Officer for more details on this process.

How do I qualify for Home Flex?

To qualify for a Home Flex, you typically need:

- Sufficient equity in your home, calculated as the STC value minus your mortgage balance.

- Stable income and employment history.

- A debt-to-income ratio within acceptable bank’s limits.

- Compliance with other underwriting criteria specified by the bank.