Welcome to ECACH EFT: The Easier Way to Make & Receive Payments!

Overview

The Eastern Caribbean Central Bank (ECCB) jointly with the commercial banks within the Eastern Caribbean Currency Union (ECCU) established the Eastern Caribbean Automated Clearing House (ECACH). The objective was to transform traditional paper based payment systems into an electronic payment system, in two phases. Phase 1 dealt with cheque imaging and was launched in March 2015.

Phase 2 is the Electronic Funds Transfer (EFT) – a secure and private electronic payment system, which allows for the transfer of funds between all commercial banks in the participating territories. Good news for businesses!

What is included?

Electronic Payments include single and multiple deposits such as Salaries, Supplier Payments, Dividend Payments, Pension Payments, Insurance Settlements and Cash Management. Debit authorizations including utility payments and insurance payments. Loan and credit payments are not accepted at this time.

Benefits?

The new system allows for easier management of payments and cashflow, and as a valued corporate customer, you can expect to benefit from:

- Enhanced security, convenience and quicker access to funds

- Improved efficiency and reduced processing time - elimination of labor-intensive manual processes

- Reduced risk of loss and theft

- Increased employee satisfaction

What has changed?

Salary and payroll submissions, which were emailed or hand delivered previously, will now be required in CSV format with additional information as follows:

| Required Information | Additional Information Required (New) |

|---|---|

| Employee Name Employee Account Number Amount |

Employee Account Type (DDA/SAV) Bank Routing/Transit Number #000000369 Reference # Effective Date |

| Previously Accepted Format(s): | New Format: |

| Excel Spreadsheet Printed Employee Listing |

CSV format |

| Previous Requirements: | New Requirements: |

| Lead time: minumum 2 business days Effective date: Optional File submission: FTP/email/cheque with listing Process typs: Manual Enrollment: Automatic with no documents |

Lead time: minimum 1 business day Effective date: Mandatory File submission: Browser only Process type: Electronic Enrollment: Required with documents |

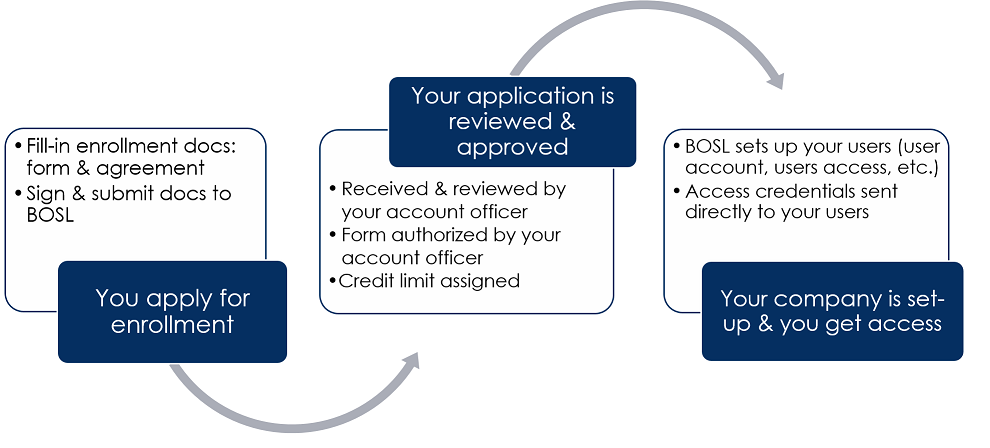

What is the enrollment process?

Further Information

Glossary of Terms

How To Apply

Frequently Asked Questions

Contact us for ECACH

FAQs

The Eastern Caribbean Automated Clearing House (ECACH) is an electronic network through ECCB for clearing and settlement of cheques and other electronic transactions within the eight territories of the Eastern Caribbean Currency Union (ECCU). Only commercial banks within the ECCU are participating.

Electronic Funds Transfer (EFT) refers to transactions that take place over the ECACH electronic payment network, either among customer accounts at the same bank or among customer accounts between participating banks locally & regionally.

The ECACH is launching EFT in an effort to provide the customers of banks within the ECCU a faster, cost-effective and secure payment solution.

The EFT process is secure, fast, convenient and cost-effective. It provides customers with the ability to transfer and settle funds between participating banks within the same day, subject to the agreed exchange timelines between the participating banks

The transactions can be funds transferred to accounts such as payroll, settlement of invoices, tax refunds, pension, dividends, etc.

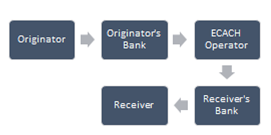

A company (Originator) will send a list of transactions/payments to be made on the accounts of its employees, clients, or suppliers, to its Financial Institution (Originator’s Bank) using the ACH software. The Originator’s Bank will send these transactions in a specific format to ECCB (ECACH Operator) for transmission to the Receiver’s/Beneficiary’s Bank (the employees, clients, or suppliers) where their accounts are held. The Receivers’ banks will in turn process these transactions.

All businesses and individuals that are doing payroll transactions via an FI and/or individuals that transfer money or pay bills within the Eastern Caribbean are impacted by the introduction of EFT. Through the new features of ACH business customers will now have the opportunity to bring all transactions to one Financial Institution within the Eastern Caribbean. With EFT there is no longer a need to split payroll and the way that people receive their money is changing. This can now be processed by one single FI.

- Name

- Account number(s)

- Account type(s)

- Bank routing/transit number(s)

- Reference #

Up to five (5) business days for enrolment, subject to the completion of forms and approval.

Yes. However, this manual process will be phased-out (A deadline date will be established by ECCB/ECACH). ECACH EFT will be the standard for processing salaries/payroll, and all customers wishing to benefit from this service will be required to enroll.