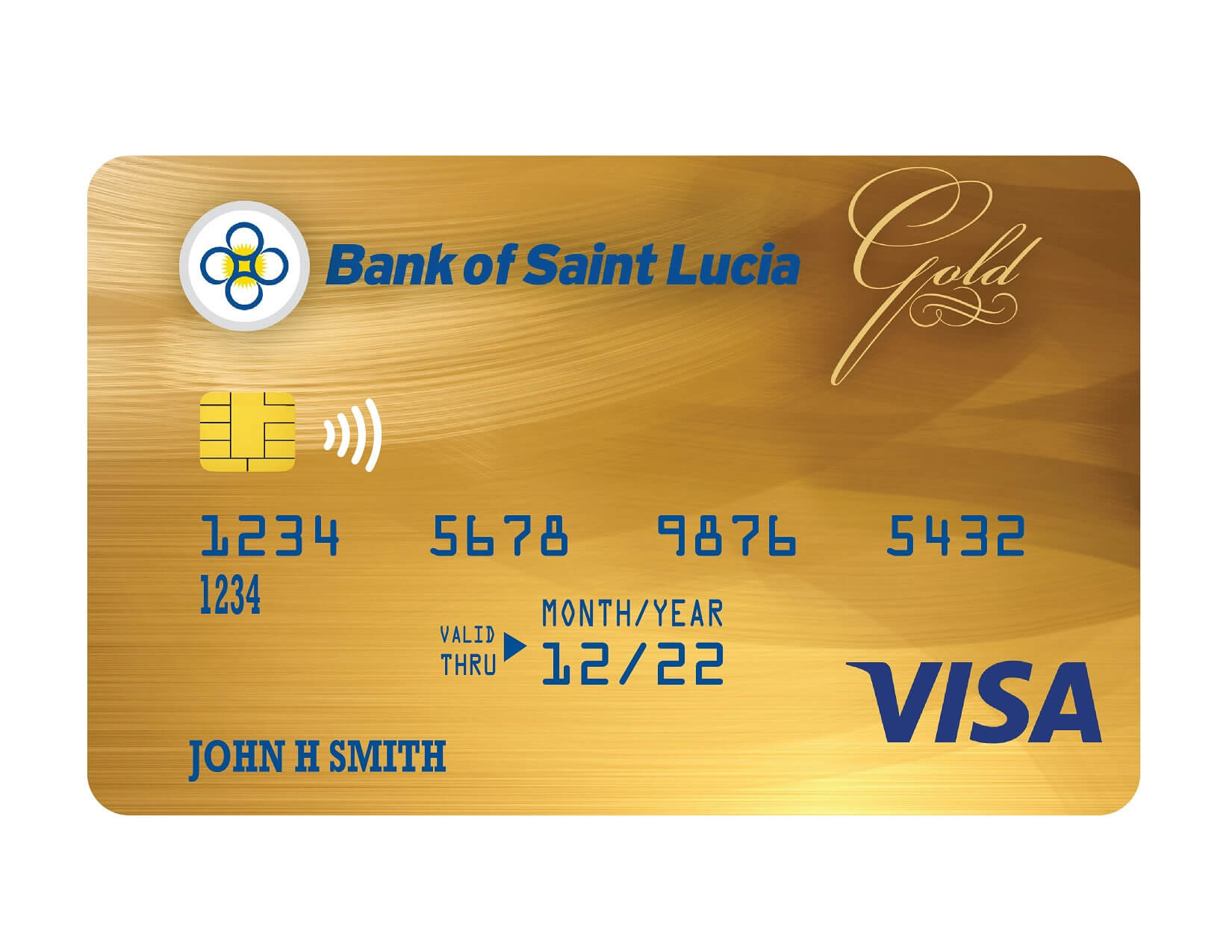

Experience BOSL VISA Gold

- Higher Credit Limits

- State of the Art Service

- Denominated in US Dollars

GOLD BENEFITS

- Access to MY Rewards!

- Free supplementary card Security

- Cash advances available from thousands of financial institutions and ATMs worldwide

- Emergency replacement card within 24hrs

- 24 hr VISA Global Service assistance

*To be eligible for coverage the ticket/rental must be paid for with your VISA Gold Credit Card

FAQs

You can apply online via our Digital Branch or visit any branch to start the application process.

To apply for a Bank of Saint Lucia Visa Credit Card, you will need the following:

- Recent Job Letter

- Recent Salary Slip

- One (1) valid national ID

- Completed Application form

Approval times can vary, but it's usually within a few days (existing customers) to a few weeks (new customers).

A credit limit is the maximum amount you can charge on your card. It's determined based on your creditworthiness and income.

The minimum payment is a small percentage of your balance, usually around 3%. It's important to pay more than the minimum to avoid high-interest charges.

Credit cards can be a valuable financial tool for everyday expenses and can also offer rewards.

Yes, you can make the minimum each month by the due date as late fees would be avoided, however it is advisable to pay in excess of the minimum payment to reduce interest charges or full statement balance for no interest altogether.