This section gives you quick and easy access to the answers to the questions we're asked most frequently. If you don't find your question here please use the Ask the Banker or the email form on the Contact Us page and we will be happy to answer your question.

What is EFT?

Electronic Funds Transfer (EFT) refers to transactions that take place over the ECACH electronic payment network, either among customer accounts at the same bank or among customer accounts between participating banks locally & regionally.

Why is EFT being launched?

The ECACH is launching EFT in an effort to provide the customers of banks within the ECCU a faster, cost-effective and secure payment solution.

What are the benefits of EFT?

The EFT process is secure, fast, convenient and cost-effective. It provides customers with the ability to transfer and settle funds between participating banks within the same day, subject to the agreed exchange timelines between the participating banks

What type of transactions can be processed through EFT?

The transactions can be funds transferred to accounts such as payroll, settlement of invoices, tax refunds, pension, dividends, etc.

How does EFT work?

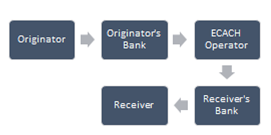

A company (Originator) will send a list of transactions/payments to be made on the accounts of its employees, clients, or suppliers, to its Financial Institution (Originator’s Bank) using the ACH software. The Originator’s Bank will send these transactions in a specific format to ECCB (ECACH Operator) for transmission to the Receiver’s/Beneficiary’s Bank (the employees, clients, or suppliers) where their accounts are held. The Receivers’ banks will in turn process these transactions.

What action is required and by whom?

All businesses and individuals that are doing payroll transactions via an FI and/or individuals that transfer money or pay bills within the Eastern Caribbean are impacted by the introduction of EFT. Through the new features of ACH business customers will now have the opportunity to bring all transactions to one Financial Institution within the Eastern Caribbean. With EFT there is no longer a need to split payroll and the way that people receive their money is changing. This can now be processed by one single FI.

What information will be required from employees, clients or suppliers?

- Name

- Account number(s)

- Account type(s)

- Bank routing/transit number(s)

- Reference #

How long does the application process take?

Up to five (5) business days for enrolment, subject to the completion of forms and approval.

Will the manual salary/payroll sheets still be accepted?

Yes. However, this manual process will be phased-out (A deadline date will be established by ECCB/ECACH). ECACH EFT will be the standard for processing salaries/payroll, and all customers wishing to benefit from this service will be required to enroll.

Where can I get more information?

Information is available from the Bank’s website, your Account Officer or through the Bank’s Online Customer Support.